Workers have a fraction of their paychecks withheld for taxes each pay period; Mr. Bush directed that this fraction be reduced in 1992. The change in the withholding rate did not change income tax rates; by withholding less in 1992, taxpayers would either receive smaller refund checks in 1993 or owe more taxes. Notice from the curve in Figure 28.2 “Plotting a Consumption Function” that when disposable personal income equals 0, consumption is $300 billion.

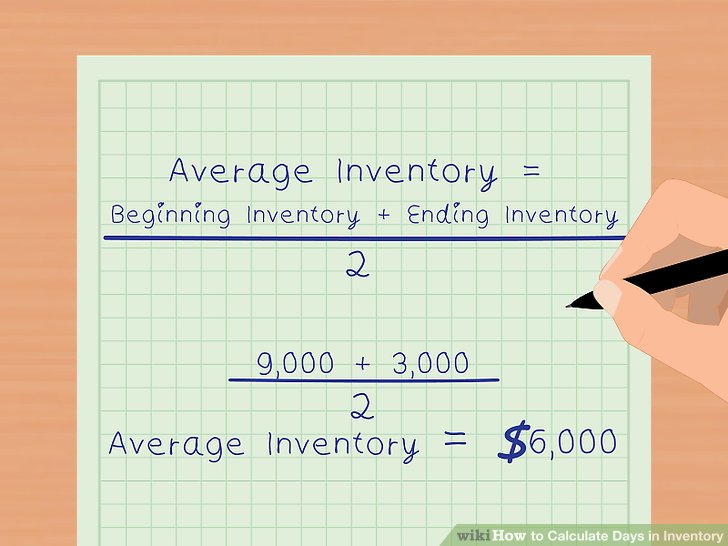

Macroeconomists are interested in aggregate consumption for two distinct reasons. First, aggregate consumption determines aggregate saving, because saving is defined as the portion of income that is not consumed. For example, imagine that Congress wants to enact a tax rebate to spur economic activity through consumer spending. MPC can be used to assess the likelihood of which household’s, based on their income, would have the greatest likelihood or propensity to spend the tax cut, rather than save it. Goods and services are affected by income and substitution in different ways.

Procedia Economics and Finance

This is especially true when it is contrasted with the volatility of an investment, Most post-Keynesians admit the consumption function is not stable in the long run since consumption patterns change as income rises. Real values of disposable personal income and consumption per year from 1960 through 2010 are plotted in Figure 28.1 “The Relationship opportunity costs and the production possibilities curve Between Consumption and Disposable Personal Income, 1960–2010”. The data suggest that consumption generally changes in the same direction as does disposable personal income.

This yields a positive result for the corporation but a negative effect for the employees who may be replaced. For each of the following events, draw a curve representing the consumption function and show how the event would affect the curve.

- John Maynard Keynes introduced the idea of the consumption function, which explains the relationship between a country’s income and spending.

- If true, aggregate savings should increase proportionally as the gross domestic product (GDP) grows over time.

- In doing so, they can adjust the total size of the rebate program to achieve the desired spending per household.

- The income effect is the change in consumption based on changes in income.

- The MPC percentage can also be used by economists to determine how much of each $1 in tax rebates will be spent.

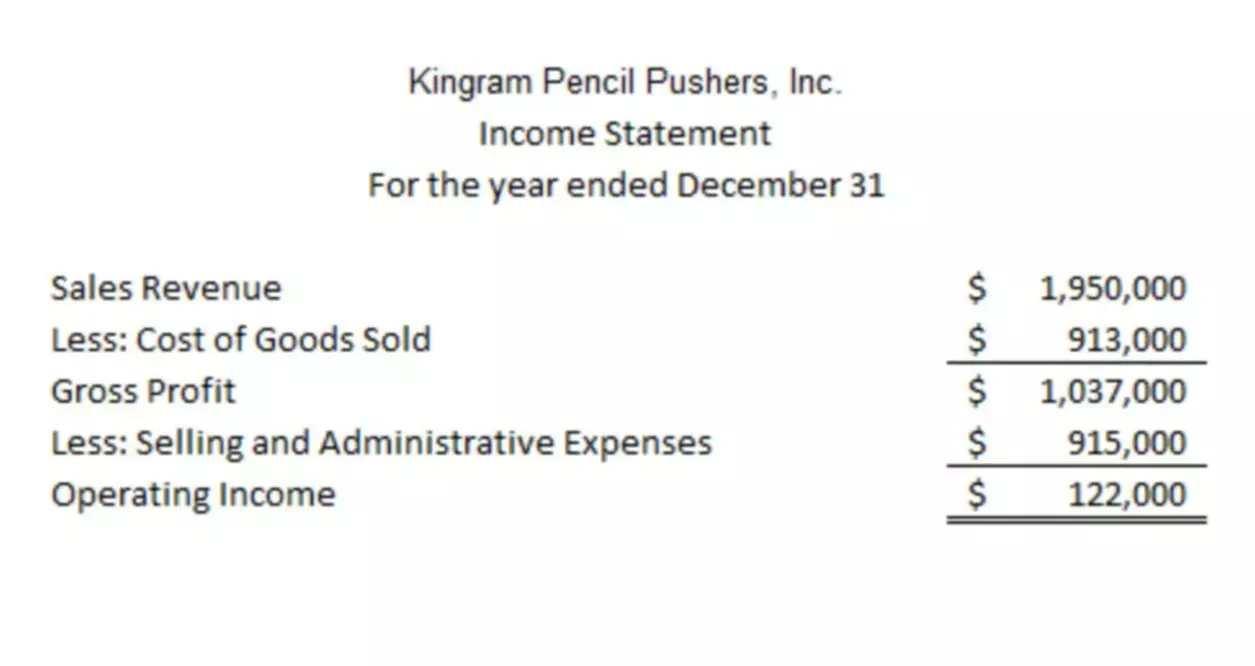

Consumption and Disposable Personal Income

MPC is the portion of each extra dollar of a household’s income that is consumed or spent. For example, if the marginal propensity to consume is 45%, out of each additional dollar earned, 45 cents is spent. The income effect is the change in consumption based on changes in income. Consumers spend difference between report form and account form balance sheets more if their income increases and spend less if their income drops. The income effect doesn’t dictate the kinds of goods consumers will buy. They may purchase more expensive goods in lesser quantities or cheaper goods in higher quantities based on circumstances and preferences.

We learned in an earlier chapter that the relationship among the price level, real wealth, and consumption is called the wealth effect. A reduction in the price level increases real wealth and shifts the consumption function upward, as shown in Panel (a). An increase in the price level shifts the curve downward, as shown in Panel (b). Indeed, it seems likely that virtually all consumption choices could be affected by expectations of income over a very long period.

Marginal Propensity to Consume vs. to Save: What’s the Difference?

So, while there is disagreement on the size of the MPC, all conclude that the impact was non-negligible. As saving is a complement of consumption, the MPS reflects key aspects of a household’s activity and its consumption habits. For example, if the marginal unearned revenue and subscription revenue propensity to save is 10%, it means that out of each additional dollar earned, 10 cents is saved. The consumption function was introduced by economist John Maynard Keynes.

Principles of Economics

MPC is important because it varies at different income levels and is the lowest for higher-income households. Notice that for every $500 billion increase in disposable personal income, personal saving rises by $100 billion. Consider points C′ and D′ in Figure 28.3 “Consumption and Personal Saving”. When disposable personal income rises by $500 billion, personal saving rises by $100 billion. More generally, the slope of the saving function equals the change in personal saving divided by the change in disposable personal income. The ratio of the change in personal saving (ΔS) to the change in disposable personal income (ΔYd) is the marginal propensity to save (MPS).

The consumption of goods and services can be affected by changes in a consumer’s income, price levels, and the availability of market substitutes. The income effect is the resulting change in demand for a good or service caused by an increase or decrease in a consumer’s purchasing power or real income. The substitution effect occurs when consumers replace one product with another due to price changes and personal finances. In the expenditure-output model, how does consumption increase with the level of national income?